Italy Checklist: Sponsoring Highly Skilled Migrant Visas

Grab a copy of a guide to international employee relocation

View E-book

Manage, track and optimize internal operations for increased efficiency of process workflow.

Gain dedicated consultants to manage your global mobility needs.

track and control assignment-related expenses for efficient budget management.

Gain insights and make informed decisions through this comprehensive feature.

Centralize expatriate information for efficient tracking, compliance, and editing.

Secure portals for uploading, storing, and managing necessary documents such as contracts, visas, and work permits.

Network of vetted suppliers offering over 60,000 mobility services across 183 countries.

track and control assignment-related expenses for efficient budget management.

Simplifies document requests and secure sharing for seamless collaboration for all stakeholders

Manage and streamline supplier deliverables for optimal performance and collaboration

Keep track of your assignment duration and length of stay in host country to support tax returns

Visa and Work Permit Processing

Comprehensive Support for Every Assignment Type

Short-Term & Long-Term Accommodations

Compliant Immigration and Visa Services

Assistance With Corporate Relocation Taxes & Social Security

Take control of your visa and immigration challenges today.

Ensure your departures are handled with care and precision.

Let our Advisory Services drive positive change in your organization.

Let us handle your immigration compliance needs while you focus on your core business.

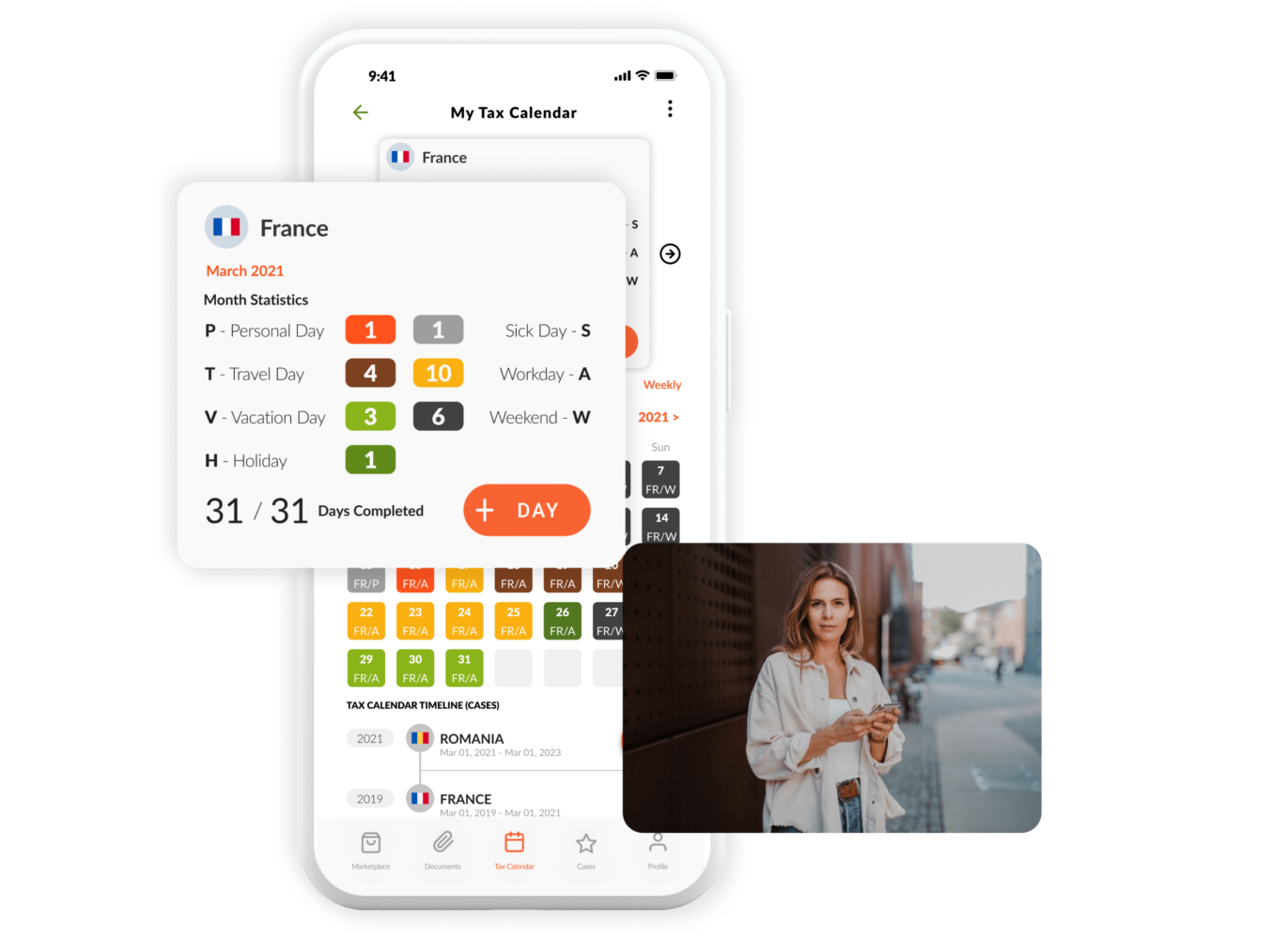

The Tax Calendar helps assignees to stay compliant by tracking the duration of their stays in each country by keeping them within the limits of tax regulations and policies. Be sure of your tax residency.

BOOK A DEMO

Simplify your tax reporting across borders and ensure compliance with ease.

A reliable tool that compiles data on the duration of assignees’ stays in each country.

Providing precise information ensures that internal tax and financial teams can generate accurate and compliant reports, eliminating the risk of errors in tax calculations and submissions.

Understanding complex stay duration data can be difficult but at xpath.global, we’ve made it easier. Our intuitive visuals transform intricate data into clear and meaningful representations. These visualizations allow for easy interpretation, helping you gain a deeper understanding of your data and simplify analysis.

With our innovative approach, even the most complex stay duration data can be easily understood at a glance.

Italy Checklist: Sponsoring Highly Skilled Migrant Visas

Grab a copy of a guide to international employee relocation

View E-book